Getting Rich (1): Why Must We Use Money to Make Money?

- LI Xiaolai

- Mar 24, 2025

- 10 min read

Updated: Aug 23, 2025

Author: Xiaolai Li, Serial editor: Mr. Y

Introduction

There is an old Chinese saying that goes, "A poor couple faces endless sorrows", which highlights the crucial role money plays in sustaining life. The experience of marriage counselors confirms this: most life's struggles are, at their core, tied to money. Even for the 1% of issues that seemed unrelated, money can still act as an effective lubricant.

So, how should we view wealth? Warren Buffett1 once spoke of money's role in his life, saying, "...It's being able to do what I want to do. I mean, I get to paint my own painting. And I get to choose the people that I associate with. I don't have to associate with people I don't like. I can arrange my own day. It's been a luxury. So, money has been a luxury to me. It's enabled me to live the life I want."

What is the meaning of money? Buffett's answer is both simple and profound: money gives you the power of choice, the ability to say no to people and things you don't agree with.

Bestselling author Li Xiaolai hit the nail on the head, pointing out that the ultimate goal of financial freedom is not wealth itself, but the "freedom" it provides. He summarized this: "When you no longer need to sell your time to meet your basic needs, you have achieved financial freedom." This is the right to choose, and more importantly, the power to control your own life.

Let's be bold and say it: money is a solid bridge to freedom. It brings a higher quantity and quality of true freedom than a state of poverty ever could. This isn't vulgar materialism, but a sober understanding of reality.

As Nobel laureate in economics F.A. Hayek once said, "Money is one of the greatest instruments of freedom ever invented by man. It is money which in existing society opens an astounding range of choice to the poor man, a range greater than that which not many generations ago was open to the wealthy." Wealth gives countless ordinary people the opportunity to take control of their own lives.

After all is said and done, for the ordinary people, on the path to freedom in life, the primary task is to make money.

This is why the most crucial but missing part of our education is teaching children "how to earn money." Likewise, the most needed shift in mindset for financially struggling adults is to help them embrace the idea that "there is no shame in being wealthy."

Just as plants need rain to flourish, human's prosperity is driven by cash flow. Therefore, the question "How to get rich?" has always been, and always will be, the most practical and central topic of human discussion.

Is financial freedom a distant dream, or is there a clear path to get there? In the "Getting Rich" series by the Blossoms Blog, we will show you that it is the latter. Renowned investor and bestselling author Li Xiaolai, in his book On Regular Investing, lays out a clear and viable path: becoming wealthy through investing.

The Blossoms Blog has excerpted content from this book to create the "Getting Rich" serial, aiming to systematically share with you this effective path to wealth.

As our opening piece, this article will first debunk a common myth and answer two fundamental questions: Why isn't investing a privilege reserved for wealthy people? And why should ordinary people not only learn to invest but also start as early as possible?

Why Must We Use Money to Make Money?

by Xiaolai Li, rewritten in English by John Gordon & Xiaolai Li ©2019

For most people, money has only one purpose: consumption. Sadly, this is the basic reason why most people are unable to achieve financial independence. They have almost never seriously thought about money's second and much more important purpose: investment.

For those who only know how to spend money and don't know how to invest, it's hard to escape their original fate. They can only make money by selling their time, and the amount of time that they can sell is quite limited –- the time we can actually use is much less than we think.

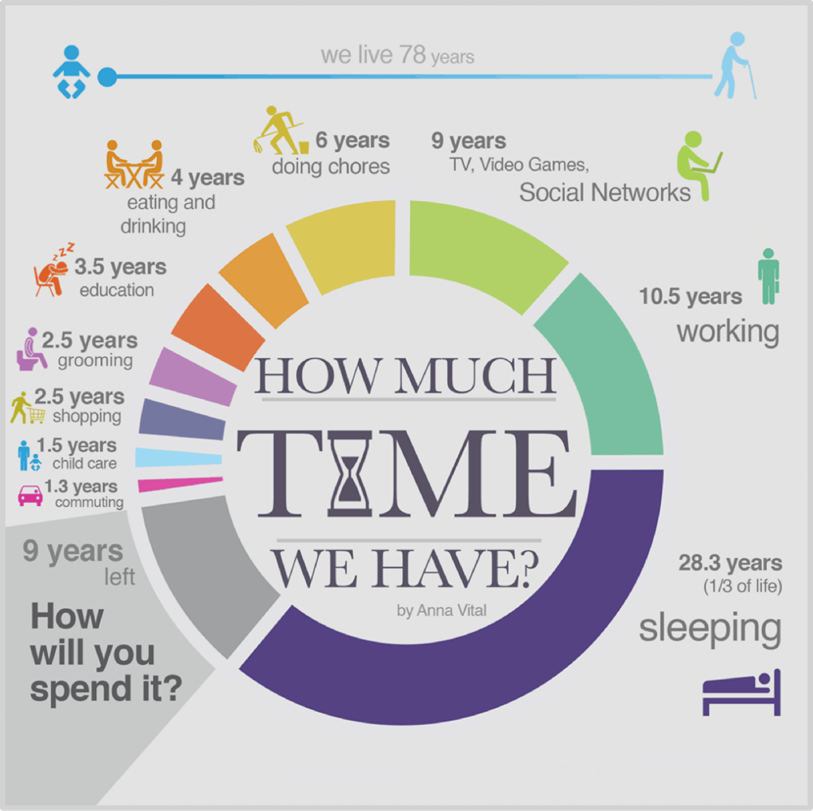

There is a set of data that can help us understand how little time we actually have to make money. If we take an average lifespan of 78 years.

We sleep for 28.3 years.

We work for only 10.5 years (this is the time that most people can sell).

We would spend 9 years watching TV, playing video games, and using social networks.

We would spend 6 years doing chores.

We would spend 4 years eating and drinking.

We would spend 3.5 years on education.

We would spend 2.5 years grooming.

We would spend 2.5 years shopping.

We would spend 1.5 years on childcare.

We would spend 1.3 years commuting.

According to these estimates, we only have 9 years left to allocate as we please! The time we can exchange for money is 10.5 years of working time plus 9 years of leisure time. Even if we allocate all of these 9 years to paid work, we still haven't doubled the time we can sell. And we still sleep more hours than we have available to sell. Sleeping is expensive!

When I was young, I worked very hard just like everyone else.

Upon graduating from college, I started working as a salesman, and there were weeks in which I spent six nights sleeping on a train. I get off the train in the morning, find a place to shower and change clothes, do sales training during the day, and take the train to the next city in the evening to start all over again.

Anyone who has known me for a long time knows that I don't have any vacations. This is because, soon after I graduated from college in 1995, I found that I had too many vacations! In China, there are 115 legal holidays (including weekends) in a year! This means that we spend one-third of the year resting! Something didn't seem right. Later I realized that "legal" holidays were created to restrict employers. It was illegal for a company to force its employees to work on holidays without paying them extra wages, but there were no limits on what an individual could do. There is no law that says: "Today is a legal holiday, and you are breaking the law if you don't take a day off!" So, from that point on, I decided that I would have nothing to do with legal holidays anymore. It's been 24 years since 1995, and I have done my best to ignore weekends and holidays. I just do what I want to do every day! I have published several books, most of which I wrote during the Spring Festival when everyone else was on vacation. I've worked very hard, haven't I?

About ten years ago, I suddenly realized what a waste of time it was to worry about hairstyles. Everyone spent hours getting their hair cut each time, and they often had to wait a long time at the barber. So, I decided that I would cut it myself. A good Phillips trimmer only costs about $50 and lasts for years. Since then, I've had the same hairstyle for the last decade -- a 3-millimeter buzz cut; every few days, a few minutes with the trimmer before I shower. Can you imagine how hard I worked to save time?

However, the numbers are a bit disappointing. How much extra time did I earn by not taking vacations for 24 years? During vacations, I have about four hours of effective work per day. If you've ever worked for yourself, you know that the amount of truly effective work time you can have in one day is small. So, how many extra productive hours have I gained by giving up vacations over the past 24 years?

24 x 115 x 4 = 11,040

Just over 10,000 hours. How many years do these correspond?

11,040 ÷ (365 x 24) = 1.26

See? I've been so hard on myself and for what? Just 14% more time than someone who worked just as hard but still took vacations. And what about the decision I made 10 years ago to cut my own hair? How much time have I saved by doing that? Assume that you have your hair cut once a month, it takes 1.5 hours, that's 18 hours per year. Over ten years, that's 180 hours. Get it? I took such good care of my time and was so hard on myself, but I only got 7.5 more days! All that effort, and I only end up with 0.228% more time than everybody else!

Frank H. Knight, one of the most influential economists of the 20th century, has a famous postulation:

Ownership of personal or material productive capacity is based upon a complex mixture of inheritance, luck, and effort, probably in that order of relative importance.

Of course, this doesn't mean that effort is unimportant. A certain level of success can be achieved through effort, but great success depends on luck, and we all know that we can't control luck (or inheritance!). The problem, as we have seen, is that we have only so many hours we can sell, which is why effort is of the least importance.

However, if we use money to make money, the situation is different. The core of investing is using money to make money, and money doesn't rest –- as long as you make the right investment, it works for you 24 hours a day, 365 days a year. How can your sweat and tears compete with that?

The reason I admire Warren Buffett so much is due to this fact:

Warren Buffett was born in 1930 and bought his first stock when he was 11. It's now 2019, so he has been investing for 78 years!

78 years! The average person only lives 78 years, and they only have an extra nine years to allocate. But Buffett's money has already been working hard for him 24 hours a day, 365 days a year, 78 years!

It's not hard to understand what a huge difference investing can make.

Editor's Note:

Admittedly, investing isn't the only path to financial freedom. Founding a big company or becoming a top expert in a field by leveraging superb skills can also lead to this goal, as we've seen with figures like Elon Musk, Lionel Messi, and Fortune 500 executives.

Undeniably, history is filled with examples of people from ordinary backgrounds who achieved immense wealth and success through their personal talent and hard working. But this path has an extremely high barrier to entry: it demands extraordinary talent. In the Middle Ages this might have been outstanding political or military genius; in the industrial era, the skill to design complicated machinery like clocks and looms; and in the information age, it has become top-tier programming ability.

However, possessing such superior skill or talent is itself a low-probability event, so rare that it's akin to a form of luck.

Fortunately, our era is quite different from the past. Its greatest gift is that even if you haven't yet shown exception talent, or even if your luck has been average, you can still invest in outstanding companies and share in their growth. This allows you to, in effect, "buy" a piece of someone else's success.

Therefore, as Li Xiaolai said: "Investing is the only reliable way for ordinary people to break the class rigidity in this era."

However, we must face a sobering reality: investing comes with immense and unique risks, a fact that can never be overstated. It's unlike any other activity we engage in daily. Even brilliant minds who achieved extraordinary success in other fields, like Isaac Newton and Winston Churchill, stumbled badly as they stepped into investment.

The reason behind this is that investing is not just an intellectual game. It demands that investors possess a strong psychological fortitude and exceptional patience to endure the long waiting period before receiving significant returns.

More importantly, as Li Xiaolai stated in his book The Path to Financial Freedom (Chinese edition), all returns are built on one crucial prerequisite; you must first find assets that are worth holding for a long period of time.

So, how should we avoid the risks? How should we build the right mindset? How should we find the right assets? The answers to all these questions point in one direction: learning, especially from a true master.

In this regard, Li Xiaolai is hailed by many as a top-tier wealth coach.

If you truly want to master investment knowledge that works for ordinary people, we strongly recommend you read his open-source book, On Regular Investing, word for word (free reading link: a xiaolai's work).

This book should be essential tutorial for anyone who hopes to achieve financial freedom through investing.

The "Getting Rich" series will continue here on the Blossoms Blog. We will follow the articles of Li Xiaolai to continue exploring the core wisdom of investing as a journey of self-improvement.

Facing the volatile and complex investment market, have you ever been troubled by the following questions?

Selecting Assets: How should you choose investments that are worth holding for the long term?

Defining a Strategy: What is the most reliable investment strategy for ordinary people? Is there a strategy that offers a "guaranteed win"?

Understanding Timelines: How long does it typically take to see significant returns on an investment?

Allocating Funds: What percentage of your money should be allocated to investments?

Strengthening Your Mindset: How to effectively build up your mental resilience during the long investment process?

Beyond investing itself, we will also explore a critical element that has always been overlooked by many people: how to evidently increase your earning power outside of the investment. Even if you don't have exceptional talent, you can still multiply your income by optimizing your personal business model and making wise career choices, thereby creating an ongoing cash flow for your investments.

The answers to all these questions will be revealed in this series. Please stay tuned.

Reference

1. Warren Buffett is an American investor and philanthropist who served as the chairman and CEO of the conglomerate holding company Berkshire Hathaway. Buffett is revered as the God of Stocks by the Chinese Internet and is well-known for this.

Copyright & Licensing Notice

The main text of "Getting Rich" serial is licensed under the Creative Commons Attribution-NonCommercial-NoDerivatives (CC-BY-NC-ND) licence.

Original text link: https://ri.firesbox.com/#/en/

The introductions and annotations in the “Getting Rich” serial are © 2025 Mr. Y.

You are free to share the main texts in accordance with the CC-BY-NC-ND licence (non-commercial use, no derivatives, credit required).

When reprinting or republishing the "Getting Rich" serial together with its introductions and annotations, please credit “Xiaolai Li” as the article author and “Mr. Y” as the serial editor and include a link to this serial on this website.

All other rights reserved.

Proof of first publication: the SHA-256 hash of the "Getting Rich" serial has been immutably recorded on a public blockchain, serving as verifiable timestamp certification of copyright ownership.

Comments